In the latest attack on the California health technology company, Theranos investors, led by Silicon Valley financier Robert Coleman, have accused the company’s executives of violating securities laws by hiding information that its blood testing product had failed to perform as promised.

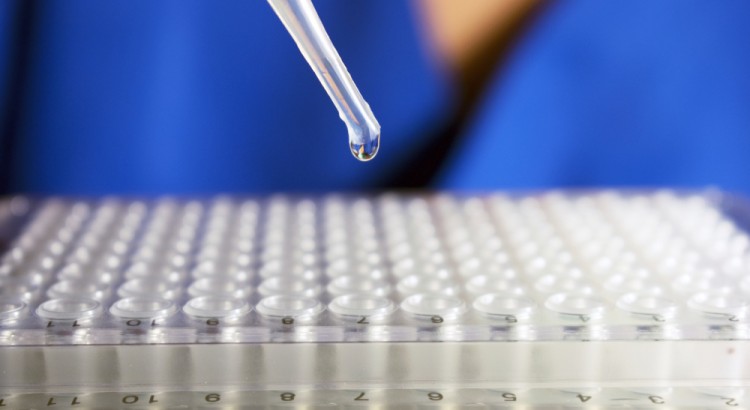

Colman and other investors accuse Theranos CEO Elizabeth Holmes and COO Ramesh Balwani of misleading the public and investors long after they knew they couldn’t deliver on their plans to run hundreds of tests on a single drop of blood.

They, along with other investors, claimed they were persuaded to invest after promises were made that the company’s technology would revolutionize the way blood tests are run. Theranos even reached a deal with Walgreens to perform blood tests in certain locations – a deal that has since been cancelled.

After media reports surfaced that the FDA did not approve the company’s specialized blood tubes, the company was forced to discontinue their use. Further sanctions came from the Centers for Medicare and Medicaid over allegedly shoddy lab practices, leading to a 2-year ban on lab ownership by Holmes, among other sanctions.

Several other proposed class actions are now pending against Theranos and Walgreens around the country, including a suit in Delaware by an investment fund seeking to rescind its stock purchase agreement based on Theranos’ allegedly fraudulent misrepresentations.

The company’s valuation has dropped from $9 billion in 2014 to around $800 million, a decrease of 90%.

Call a Los Angeles Securities Fraud Attorney Today

If you invested with Theranos, you may have certain legal rights that require your immediate attention.

Contact an experienced Los Angeles securities fraud attorney today for a consultation to discuss your rights and options.